Addendum C: ASIC Class Relief, Wrapped RMBS & Global Alignment

ASIC Corporations (Eligible Tokens—Distribution Relief) Instrument 2025/___; ASIC Corporations (Digital Asset Custody—Omnibus Accounts) Instrument 2025/___; ASIC INFO 225 (Updated 29 October 2025); CP 381; CS 32; CFTC Tokenized Collateral Guidance (Dec 2025).

This Addendum C updates the Blockchain Securitisation – Australian RMBS Framework to reflect ASIC’s December 2025 class relief for eligible stablecoins and eligible wrapped tokens, new omnibus custody allowances, and the emerging international convergence with the U.S. CFTC’s Tokenized Collateral Guidance.

The Smart SPV™ structure, Mortgage NFTs™ and tokenised RMBS debentures remain legally intact. What changes is the friction around them: intermediary licensing, settlement instruments and custody are now treated with more nuance, and are increasingly harmonised with U.S. standards for tokenised collateral.

C.1 Executive Summary

ASIC’s December 2025 relief package introduces targeted exemptions for intermediaries dealing in eligible stablecoins and eligible wrapped tokens, and permits licensed custodians to operate omnibus digital-asset accounts.

These reforms do not alter the fundamental treatment of RMBS notes as debentures or the trustee-centric Smart SPV™ architecture. Instead, they reduce the licensing and operational drag previously assumed at the edges of the model.

Tokenised RMBS structures remain compliant as debentures under the Corporations Act, but now benefit from:

- broader and simpler distribution pathways for wrapped RMBS tokens,

- increased flexibility in settlement instruments via eligible stablecoins, and

- reduced custody friction for institutional investors via omnibus accounts.

C.2 Overview of ASIC’s Relief Package

C.2.1 Distribution Relief for “Eligible Tokens”

ASIC now exempts qualifying intermediaries from AFSL, market-licensing and CS-licensing requirements when they distribute:

- Eligible stablecoins, and

- Eligible wrapped tokens,

provided that:

- the underlying asset is a regulated financial product,

- the wrapper preserves all legal and economic rights 1:1,

- no synthetic leverage or derivative transformation is introduced,

- the issuer is licensed or has submitted the relevant licence application, and

- disclosure, conduct and record-keeping obligations are satisfied.

C.2.2 Custodial Relief: Omnibus Digital-Asset Accounts

Licensed custodians may now hold digital-asset financial products in a single omnibus account serving multiple clients, where:

- client-level sub-ledgers are maintained,

- daily reconciliation is performed,

- beneficial interests remain clearly identifiable, and

- custody remains consistent with existing client asset standards.

Operationally, multiple investors can share one wallet; legally, each investor’s ownership remains distinct.

C.3 Alignment With the Existing Framework

The parent framework and prior addenda deliberately assumed a “full-friction” perimeter:

- every token distributor was treated as requiring full licensing,

- wallet-level segregation was treated as mandatory,

- wrapped RMBS distribution was assumed to trigger facility licensing, and

- stablecoin usage was assumed to require broad AFSL coverage.

The December 2025 relief makes these assumptions over-conservative but does not touch the underlying securitisation architecture:

- RMBS security tokens remain debentures,

- trustee-governed Token Deeds and waterfalls remain core,

- true sale and PPSA perfection remain unchanged.

The relief modifies intermediary obligations, not issuer obligations.

Crucially, the principles ASIC relies on—technology neutrality, rights-equivalence and custody robustness—are consistent with standards now emerging in other jurisdictions, including the CFTC’s Tokenized Collateral Guidance, which also affirms that tokenisation does not change the legal or economic character of the underlying asset.

C.4 Updated Token Classification

C.4.1 RMBS Security Tokens

Tokenised RMBS notes remain financial products (debentures or MIS interests). They sit outside the class relief and continue to be governed by standard issuer and trustee obligations.

C.4.2 Mortgage NFTs™

Mortgage NFTs™ remain digital records of entitlements and do not become financial products unless they are coupled with income or investment rights. No changes arise from the relief.

C.4.3 Eligible Stablecoins

Eligible stablecoins can be used as settlement instruments where issuers and tokens satisfy ASIC’s criteria. Intermediaries handling only these tokens may rely on the class relief instead of full licensing, lowering friction at the settlement edge of the Smart SPV™.

C.4.4 Eligible Wrapped Tokens

A wrapped token is considered eligible where:

- it is a strict 1:1 representation of the underlying regulated asset,

- it adds no new rights, leverage or derivative payoffs,

- the issuer is licensed or has applied for licensing, and

- documentation clearly links the token to enforceable underlying rights.

A wrapped RMBS note meets this test where the Token Deed preserves full legal and economic equivalence with the underlying debenture.

This logic is consistent with the CFTC’s approach to tokenised collateral, which similarly conditions eligibility on rights-equivalence rather than on the use of any particular technology.

C.5 Implications for the Smart SPV™

C.5.1 Settlement Layer

The T+0 On-Ramping™ mechanism can use eligible stablecoins for settlement without forcing every intermediary into full AFSL or facility licensing, provided eligibility conditions and disclosure requirements are met.

C.5.2 Custody Layer

Institutional investors may hold RMBS tokens and related digital-asset financial products in omnibus custody accounts run by licensed custodians, while the Smart SPV’s trustee wallets remain fully segregated and under trustee control.

C.5.3 Secondary Distribution

Platforms distributing eligible stablecoins or eligible wrapped RMBS tokens can rely on the relief, reducing the licensing and infrastructure burden for secondary markets in tokenised RMBS, while leaving issuer and trustee obligations intact.

C.6 Compliance and Disclosure

C.6.1 Conditional Relief

Relief is conditional, not absolute. Participants must:

- continuously verify token and issuer eligibility,

- maintain robust record-keeping of rights mappings,

- comply with all disclosure and conduct conditions.

C.6.2 Transitional Nature

The relief is explicitly transitional toward the forthcoming Digital Assets Framework Bill 2025. Any structure relying on the relief must be prepared to migrate into the new licensing regime when enacted.

C.6.3 Verifiable PDS™ Updates

The Verifiable PDS™ templates used in the framework should now:

- identify any use of eligible stablecoins or eligible wrapped RMBS tokens in settlement or distribution,

- flag where intermediaries rely on ASIC class relief,

- explain transition risk if the relief is narrowed, withdrawn or superseded, and

- describe clearly how a wrapped RMBS token maps back to the underlying debenture in legal terms.

C.7 Updated Compliance Matrix

| Function | Pre-Relief Interpretation | Post-Relief Position |

|---|---|---|

| Stablecoin Distribution | Assumed to require AFSL and potentially market/CS licences for intermediaries. | Distribution of eligible stablecoins can be exempt for intermediaries meeting ASIC conditions. |

| Wrapped RMBS Tokens | Assumed to attract full licensing obligations for secondary distributors. | Wrapped RMBS tokens can qualify as eligible wrapped tokens if 1:1 with the underlying RMBS note. |

| Digital-Asset Custody | Wallet-level segregation expected for all client holdings. | Omnibus accounts permitted for licensed custodians, with strict sub-ledgering and reconciliation. |

| Smart SPV Settlement | Expected to run only through fully licensed fiat rails and intermediaries. | Eligible stablecoins and eligible wrapped RMBS tokens can be used on more flexible rails under class relief. |

C.8 Conclusion

ASIC’s December 2025 class relief does not rewrite the Smart SPV™; it removes unnecessary drag around it. RMBS notes remain regulated debentures, trustees remain accountable, and the dual-layer legal–digital structure remains the backbone.

What changes is the ease with which this structure can plug into real markets: exempt intermediaries can handle eligible settlement tokens and wrapped RMBS notes; institutional investors can use omnibus custody; and the Smart SPV™ can operate inside a more flexible, still-compliant perimeter.

Because these principles are now echoed internationally—particularly in the CFTC’s framework for tokenised collateral—the model also benefits from growing cross-border regulatory alignment.

C.9 International Harmonisation: ASIC & CFTC

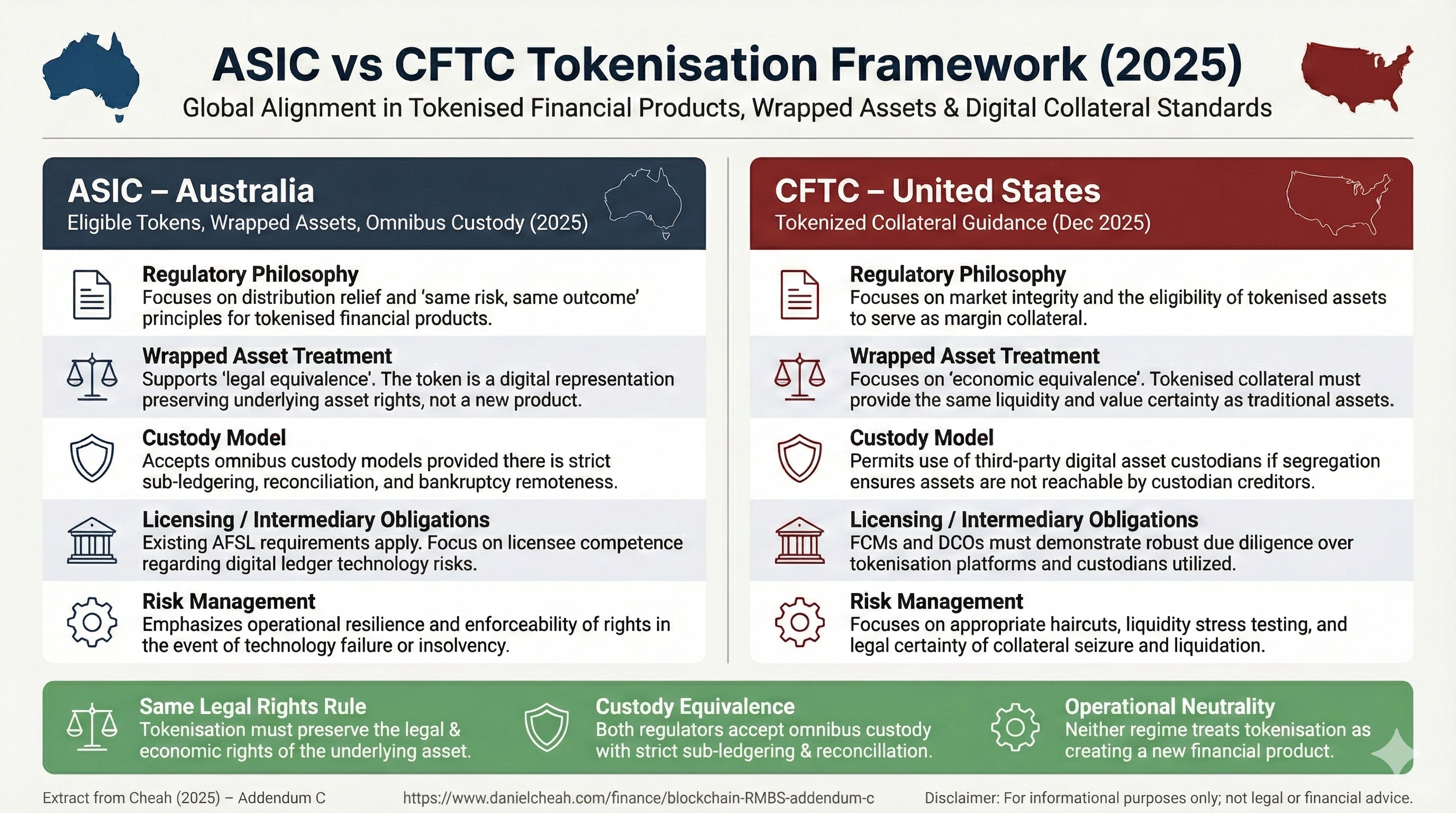

The U.S. Commodity Futures Trading Commission’s Tokenized Collateral Guidance (Dec 2025) sets expectations for using tokenised real-world assets as collateral in futures and swaps markets. Despite different statutory regimes, there is strong convergence with ASIC’s approach:

- Technology neutrality: tokenisation does not change the underlying asset’s legal or economic nature.

- Rights-equivalence: wrapped or tokenised forms must provide the same rights as the traditional form.

- Custody robustness: enforceable security interests, segregation and reconciliation are non-negotiable.

- Risk continuity: haircuts, stress testing and liquidity assumptions follow the underlying asset, not the technology.

A wrapped RMBS note that preserves 1:1 rights therefore fits within both ASIC’s eligible-wrapped-token concept and the CFTC’s tokenised-collateral expectations, subject to each regime’s specific margin or eligibility tests.

This alignment strengthens the case for tokenised Australian RMBS as a credible cross-border instrument and reinforces the decision to anchor the framework in strict rights-equivalence and trustee-led custody.

ASIC vs CFTC Tokenisation Framework (2025)

C.10 References

- ASIC Corporations (Eligible Tokens — Distribution Relief) Instrument 2025.

- ASIC Corporations (Digital Asset Custody — Omnibus Accounts) Instrument 2025.

- ASIC INFO 225 — Digital assets: Financial products and services (Updated 29 October 2025).

- ASIC Consultation Paper CP 381 — Updates to INFO 225.

- ASIC Consultation Statement CS 32 — Proposed relief for stablecoins and wrapped tokens.

- CFTC, Tokenized Collateral Guidance, Market Participants Division, Division of Market Oversight, Division of Clearing and Risk, 8 December 2025.

- President’s Working Group on Digital Asset Markets (2025), Strengthening American Leadership in Digital Financial Technology.